The Global Climate Action Fund (the Sub-Fund) has sustainable investment as its objective and is therefore considered to be in compliance with Article 9 of the SFDR1 .

This disclosure is made in compliance with Article 10 of SFDR, and sets out key information with regards to the sustainable investment objective the Sub-Fund. This information is summarized as follows:

The sustainable investment objective and the sustainability indicators of the Sub-Fund are monitored during initial security selection and ongoing portfolio management using a combination of internal and external data.

The Sub-Investment Manager’s overall investment process includes both quantitative and qualitative metrics to measure how the sustainable investment objective of the Sub-Fund is met, including an exclusionary framework, positive selection process and use of PAI metrics.

The Sub-Investment Manager uses a range of data sources in order to monitor the sustainable investment objective of the Sub-Fund, including both in-house research and third party data provider(s). These are used to systematically screen client portfolios for sustainability risks, identify priority companies for engagement and to inform company analysis as described in the Sub-Fund’s investment policy. The third party data provider(s) are subject to ongoing review and change and may differ between asset classes or sub-funds depending on the nature of the indicator to be measured.

The main limitation to the methodologies and data sources is the lack of global reporting standards and availability of consistent data. Where data is available, this also has limitations and is subject to estimation and reporting gaps and continues to evolve. The Sub-Investment Manager keeps under review the sources of data it uses for the implementation of its sustainability policy and will make changes where it considers necessary.

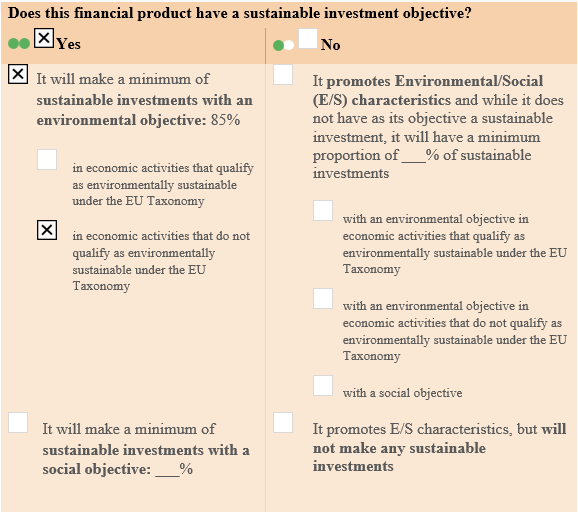

This financial product has sustainable investment as its objective.

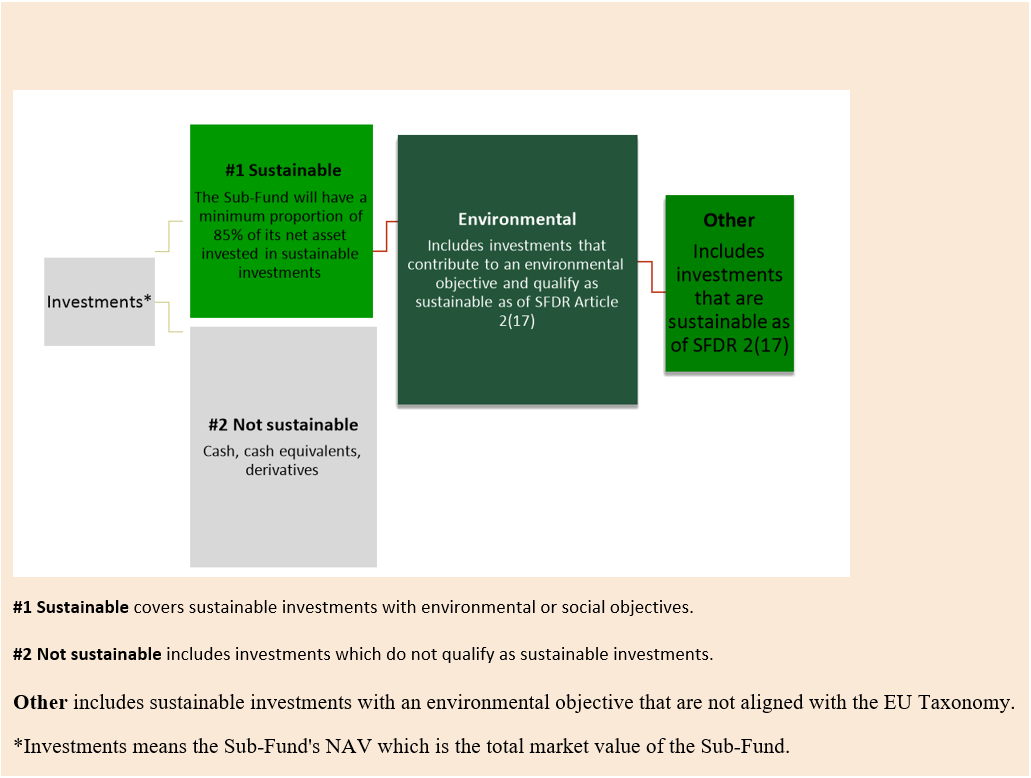

The Sub-Fund commits to investing a minimum proportion of 85% of its portfolio in sustainable investments with an environmental objective, with these investments contributing to the sustainable investment objective by making positive contributions to climate change.

Although the Sub-Fund does not commit to a minimum level of taxonomy alignment, the Sub-Investment Manager expects that the Sub-Fund’s sustainable investments may contribute to climate change mitigation and climate change adaptation.

The Sub-Investment Manager has fully integrated ESG considerations into the investment decision making process. As part of this overall approach, the Sub-Investment Manager ensures that the sustainable investments made by the Sub-Fund Do No Significant Harm (“DNSH”) to sustainable investment objectives by (a) adhering to an exclusion framework and (b) identifying and considering the principal adverse impacts (“PAI”) on sustainability factors.

In addition, the Sub-Investment Manager applies positive selection criteria as further explained in the “Investment Strategy” section below.

Each of these elements is further explained below:

a) Exclusion Framework

The Sub-Fund adheres to an exclusion framework where certain companies are removed from the investment universe based on the Sub-Investment Manager’s proprietary exclusion criteria and, to the extent not already covered by the Sub-Fund’s proprietary exclusion framework, the exclusions required under the EU Paris-aligned Benchmarks (“PAB Exclusions”). The Sub-Fund’s proprietary exclusion framework screens out companies with products or within industries that are considered by the Sub-Investment Manager to be unsustainable or associated with significant environmental or social risks. Currently, companies are automatically eliminated from investment consideration if they derive:

a) more than 25% of revenue from fossil fuel based power generation;

b) more than 5% of revenue from alcohol, tobacco, adult entertainment, gambling operations or conventional weapons; and

c) any revenue from oil and gas exploration, extraction, manufacturing, distribution or refining or thermal coal exploration, mining, extraction, distribution or refining.

The Sub-Fund’s exclusion framework may be updated from time to time.

The additional PAB Exclusions (being those not already covered by the Sub-Fund’s proprietary exclusion framework) are companies:

a) involved in any activities related to controversial weapons;

b) involved in the cultivation and production of tobacco;

c) that are considered by the third party data provider(s) used by the Sub-Investment Manager to be in violation of the United Nations Global Compact (“UNGC”) principles or the Organisation for Economic Cooperation and Development (“OECD”) Guidelines for Multinational Enterprises;

d) that derive 50% or more of their revenues from electricity generation with a GHG intensity of more than 100g CO2 e/kWh.

As such, subject to the Sub-Fund’s ESG selection process as described herein, companies deriving up to 25% of revenue from fossil fuel based power generation may be included in the Sub-Fund’s portfolio. For instance, companies that are still relying on fossil fuel to some extent (e.g. to ensure grid reliability), but have adopted an aggressive decarbonisation pathway and/or are growing their renewable energy portfolios.

Where no data is available from the third party data provider(s) regarding compliance with the exclusion framework above, issuers will not be automatically excluded from the Sub-Fund’s investment universe provided that they satisfy other sustainability-related quantitative or qualitative analysis the Sub-Investment Manager considers relevant.

The Sub-Fund will also consider other sustainability and/or ESG-related attributes of companies when choosing whether to invest except for cash and cash equivalents or derivatives, subject to data availability. These attributes may include, but are not limited to, a company’s performance on and management of certain environmental factors, such as natural resource use, social factors such as labour standards and diversity considerations, and governance factors such as board composition and business ethics. This forms a material part of the Sub-Fund’s DNSH test.

The exclusionary framework explained is aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight fundamental conventions identified in the Declaration of the International Labour Organization on Fundamental Principles and Rights at Work and the International Bill of Human Rights.

b) PAI on sustainability factors

The Sub-Investment Manager has assessed the PAI indicators relevant to the Sub-Fund and which the Sub-Investment Manager considers should be taken into account for the purposes of assessing whether sustainable investments otherwise cause significant harm.

Based on data availability, the following PAI indicators are taken into consideration for investments in equities and/or fixed income products issued by corporate issuers for the proportion of holdings where data is available:

1. Scope 1 GHG emissions

2. Scope 2 GHG emissions

3. Scope 3 GHG emissions

4. Total GHG emissions

5. Carbon footprint

6. GHG intensity of investee companies

7. Share of investments in companies active in the fossil fuel sector

8. Share of non-renewable energy consumption and non-renewable energy production of investee companies from non-renewable energy sources

9. Energy consumption in GWh per million EUR of revenue of investee companies, per high impact climate sector

10. Share of investments in investee companies with sites/operations located in or near to biodiversity-sensitive areas

11. Tonnes of emissions to water generated by investee companies per million EUR invested, expressed as a weighted average

12. Tonnes of hazardous waste generated by investee companies per million EUR invested, expressed as a weighted average

13. Share of investments in investee companies that have been involved in violations of the UNGC principles or OECD Guidelines for Multinational Enterprises

14. Share of investments in investee companies without policies to monitor compliance with the UNGC principles or OECD Guidelines for Multinational Enterprises or grievance /complaints handling mechanisms to address violations of the UNGC principles or OECD Guidelines for Multinational Enterprises

15. Average unadjusted gender pay gap of investee companies

16. Average ratio of female to male board members in investee companies

17. Share of investments in investee companies involved in the manufacture or selling of controversial weapons

For investments in sovereign bonds and bonds issued by supranational entities, the following PAI indicators will be considered:

1. GHG intensity of investee countries

2. Absolute number of investee countries subject to social violations

3. Relative number of investee countries subject to social violations

4. Non-cooperative tax jurisdictions

The Sub-Investment Manager aims to identify the adverse sustainability impact from the Sub-Fund’s investments in several ways, including via general screening criteria, ongoing review of PAIs and where appropriate supplemented by fundamental research during the Sub-Investment Manager’s investment processes. Subject to data availability, the Sub-Investment Manager, with subject matter support from the Manulife IM’s Sustainable Investment team, is responsible for assessing and monitoring the above PAI indicators for all in-scope assets on an ongoing basis using an internally developed monitoring system, third-party data, company issued data and public information. This assessment may include both fundamental as well as quantitative analysis. Issuers identified as outliers on specific indicators, or which exhibit high adverse impact across several indicators will be subject to further analysis by the Sub-Investment Manager and may be reviewed by the Sustainable Investment team.

All specific PAI indicators that are taken into consideration for the Sub-Fund, both at an overall portfolio level and in relation to the DNSH assessment for sustainable investment, are subject to data availability. The Sub-Investment Manager monitors data availability on an ongoing basis with the aim to improve both data quality and availability.

PAI outcomes for the Sub-Fund will be reported on an ongoing basis in the periodic reporting.

The sustainable investment objective of the Sub-Fund is to invest at least 85% of its net assets in a diversified portfolio of companies who are Climate Leaders as defined by the Sub-Investment Manager or companies which are sustainable investments making a contribution to climate change, but do not fully satisfy the Sub-Investment Manager’s criteria to be a Climate Leader. It is anticipated that at least 80% of the Sub-Fund’s net assets will be invested in Climate Leaders.

The Sub-Fund will contribute to climate change mitigation and climate change adaptation by investing in Climate Leaders or other sustainable investments. These are companies that are considered by the Sub-Investment Manager to be aligned with the principles of the Paris Agreement. Further details on the Sub-Investment Manager’s selection process are included in the section “Investment Strategy” below.

The Sub-Fund seeks to build a globally diversified portfolio of Climate Leaders and other sustainable investments, which aims to align with the principles of the Paris Agreement while also utilising a proprietary method to identify companies whose economic earnings and cash-based return on capital demonstrate the potential for delivering long-term growth and attractive risk-adjusted returns.

In order to select companies that are Climate Leaders, the Sub-Investment Manager will consider companies that have: (i) committed to Science-Based Targets with the Science SBTi; or (ii) lower relative carbon intensity that is within the lowest 35% of their given industry; or (iii) a portion of revenues (a minimum of 20%) resulting from climate solutions including, but not limited to, renewable energy, energy efficiency or electric vehicles.

In relation to criterion (i) above, Science-Based Targets with the SBTi are greenhouse gas (“GHG”) emissions reduction targets validated by the SBTi to align with reduction pathways for limiting global temperature rise to 1.5°C, 2°C or well-below 2°C compared to pre-industrial temperatures including near-term (5 to 10 years), long-term (more than 10 years) and net-zero targets. For near-term target, companies should achieve at least an annual 4.2% reduction for scope 1 & 2 GHG emissions and an annual 2.5% reduction for scope 3 GHG emissions. For long-term target, companies should achieve a 90% reduction for scope 1 & 2 and scope 3 GHG emissions by 2050 or sooner. Net-zero target means reaching net-zero value chain GHG emissions by no later than 2050. GHG emissions screening, inventory and target-setting should be performed in accordance with GHG Protocol Corporate Standard, GHG Protocol Scope 2 Guidance, GHG Protocol Corporate Value Chain and other SBTi criteria and recommendations issued from time to time. Companies held pursuant to criterion (i) are periodically reverified against the SBTi’s latest published list of companies that have (a) signified commitment to develop Science-Based Targets (which are subject to SBTi due diligence reviews as required) or (b) set Science-Based Targets which have been independently validated by the SBTi.

In relation to criterion (ii) above, companies within industries with higher level of carbon intensity may still be identified as “Climate Leaders” if such companies have managed to maintain a lower relative carbon intensity than their peers in their respective industries, and may be included in the Sub-Fund’s portfolio for their relative success in reducing their carbon footprint.

To select companies which are sustainable investments contributing to climate change but do not fully satisfy the Sub-Investment Manager’s criteria to be a Climate Leader, the Sub-Investment Manager will consider companies that have: (i) lower relative carbon intensity relative to the Sub-Fund’s benchmark; or (ii) lower water intensity relative to the Sub-Fund’s benchmark; or (iii) lower waste intensity relative to the Sub-Fund’s benchmark.

The Climate Leaders and other sustainable investments evaluation will be determined by the Sub-Investment Manager using a proprietary methodology which aims to incorporate all relevant environmental factors, considering and processing third-party data.

The investment strategy and selection process are applied to all assets of the Sub-Fund, except for cash and cash equivalents or derivatives but there may be a small proportion of companies which are sustainable investments making a contribution to climate change but that do not fully satisfy the Sub-Investment Manager’s criteria to be a Climate Leader.

Over time issuers’ eligibility status with respect to the relevant ESG criteria in the Sub-Fund’s stock selection process as described above may change and some issuers who were eligible when purchased by the Sub-Fund may become ineligible. When this occurs, the Sub-Investment Manager may engage with issuers to have a constructive dialogue in order to improve factors that lead to ineligibility within the next 90 days. The position in respect of such issuers may be divested at any time or for any reason during this 90-day period.

Further details on the wider investment strategy used to attain the sustainable investment objective of the Sub-Fund are included in the investment policy.

Please also see the Sub-Investment Manager’s Sustainable Investing and Sustainability Risk Statement for further details on how the Sub-Investment Manager integrates sustainability into its investment process to ensure that it is applied on a continuous basis.

The following elements of the investment strategy are binding within the selection process:

All of the above elements are binding on the Sub-Investment Manager on a continuous basis.

Good governance practices of investee companies of the Sub-Fund are evaluated across various steps of the security selection process. Governance safeguards are inherent in the Sub-Investment Manager’s level norms-based screening as well as the Sub-Investment Manager’s PAI processes for the Sub-Fund.

Furthermore, at the Sub-Fund level, investee companies are screened for good governance principles at the point of investment and on an ongoing basis. This screening process includes sound management structures, employee relations, remuneration of staff and tax compliance, and is based on third-party data, and/or a proprietary assessment.

A proprietary assessment will be used and may take precedence over the third-party data, when the Sub-Investment Manager determines to engage with the investee companies or the Sub-Investment Manager otherwise evidences the good governance practices of investee companies, or when third- party data is lacking, the Sub-Investment Manager applies these principles by assessing issues including but not limited to: companies’ board composition and oversight, executive compensation, labor management and human capital and tax controversies.

The selection of these specific indicators is subject to change from time to time although the overall principles will remain. Where the Sub-Investment Manager identifies any areas for improvement, and subject to an overall assessment of good governance, it may engage with the relevant investee company to seek improvements before choosing to divest, which will typically occur within 90 days. The assessment is not applicable to any cash, cash equivalent or derivatives investment or investments in securities issued by sovereigns or government-related entities.

The Sub-Fund is to invest at least 85% of its net assets in a diversified portfolio of companies who are Climate Leaders as defined by the Sub-Investment Manager or companies which are sustainable investments making a contribution to climate change, but do not fully satisfy the Sub-Investment Manager’s criteria to be a Climate Leader. In order to select companies that are Climate Leaders, the Sub-Investment Manager will consider companies that have: (i) committed to Science-Based Targets with the Science Based Targets initiative (SBTi); or (ii) lower relative carbon intensity that is within the lowest 35% of their given industry; or (iii) a portion of revenues resulting from climate solutions including, but not limited to, renewable energy, energy efficiency or electric vehicles. It is anticipated that at least 80% of the Sub-Fund’s net assets will be invested in Climate Leaders.

To select companies which are sustainable investments contributing to climate change but do not fully satisfy the Sub-Investment Manager’s criteria to be a Climate Leader, the Sub-Investment Manager will consider companies that have: (i) lower relative carbon intensity relative to the Sub-Fund’s benchmark; or (ii) lower water intensity relative to the Sub-Fund’s benchmark; or (iii) lower waste intensity relative to the Sub-Fund’s benchmark.

The exposures to these investments will be direct. The Sub-Fund may use derivatives for hedging and/or efficient portfolio management purposes. However, derivatives instruments will not be used to attain the sustainable investment objective of the Sub-Fund.

The Sub-Fund may hold up to 20% of the remaining assets in cash, cash equivalents and/or equity and equity-related securities of companies that do not satisfy the definition of Climate Leaders but undertake economic activities that contribute to the environmental objective of the Sub-Fund through key resource efficiency requirements which will result in lowering either Green House Gas emission intensity, water and/or waste intensity.

The Sub-Fund will have a minimum proportion of 85% of its net asset invested in sustainable investments. The remaining investments will be in cash, cash equivalents and derivatives.

The asset allocation may change over time and percentages should be seen as an average over an extended period of time. Calculations may rely on incomplete or inaccurate company or third-party data.

The sustainable investment objective of the Sub-Fund is measured and monitored throughout the lifecycle of an investment using the following sustainability indicators:

The sustainable investment objective and the sustainability indicators of the Sub-fund are monitored during initial security selection and ongoing portfolio management using a combination of internal and external data.

Once an investment is made, and to ensure that investments continue to meet the Sub-Fund’s sustainability criteria, the Sub-Investment Manager continues to monitor material factors that could impact an investment, including sustainability risks and factors. Relevant risks or concerns are addressed as part of the Sub-Investment Manager’s ongoing investment process which may result in changes in a fund position size or divestment. The Sustainable Investment team may also conduct reviews on a periodic basis, and engage with the investment team about potential sustainability risks.

The Sub-Investment Manager uses a combination of externally sourced data and proprietary research to ensure that the information used when monitoring the sustainable investment objective of the Sub-Fund is suitably robust, given the current levels of disclosure by companies, and performs periodic reviews allowing the Sub-Investment Manager to seek to identify gaps and/or data that may require further review. The current level of disclosure of environmental and social characteristics remains comparatively limited in comparison with other financial data, and that which is available is typically subject to more limited review (such as audits).

The Sub-Investment Manager’s overall investment process includes both quantitative and qualitative metrics to measure how the sustainable investment objective of the Sub-Fund is met, including an exclusionary framework, positive selection process and use of PAI metrics. In addition, the Sub-Investment Manager seeks to understand the sustainability risks and opportunities by using a range of external research providers as well as internal research.

Each sustainability indicator for the Sub-Fund is subject to measurement using clearly defined metrics on an ongoing basis, using a combination of internal and external data and research as is appropriate for the particular indicator.

The Sub-Investment Manager uses a range of data sources in order to monitor the sustainable investment objective of the Sub-Fund, including both in-house research and third party data provider(s). These are used to systematically screen client portfolios for sustainability risks, identify priority companies for engagement and to inform company analysis as described in the Sub-Fund’s investment policy. The third party data provider(s) are subject to ongoing review and change and may differ between asset classes or sub-funds depending on the nature of the indicator to be measured.

The Sub-Investment Manager acknowledges that, given the lack of a consistent standard of global regulatory requirements on sustainability disclosures generally, third party provider(s) upon whom the Sub-Investment Manager places reliance, do have to estimate datapoints and the proportion of estimations used will vary depending on the subject matter and asset in question. The Sub-Investment Manager does not seek to systematically audit those estimates but does challenge numbers with third-parties if it identifies data it believes is inaccurate, and where possible places greater reliance on actual disclosed data. The Sub-Investment Manager seeks to encourage adoption of sustainability disclosure standards by issuers and thus decrease reliance in the industry on estimated or incomparable information.

The main limitation to the methodologies and data sources is the lack of global reporting standards and availability of consistent data. Where data is available, this also has limitations and is subject to estimation and reporting gaps and continues to evolve. The Sub-Investment Manager keeps under review the sources of data it uses for the implementation of its sustainability policy and will make changes where it considers this is necessary.

In case data gaps pose challenges to making an informed decision on an aspect of the investment process, the Sub-Investment Manager’s Sustainable Investment team, together with the investment analysts and fund managers may seek further information. Such options may include a direct dialogue with the company, a dedicated engagement plan or a decision against holding the company.

Due diligence is a key element of the methodology for integrating sustainability factors into the investment decision making process, on both a pre-investment and ongoing basis. As part of the due diligence process, the investment team seeks to assess sustainability risks and factors material to an investment, and incorporate these issues into fundamental analysis, which then may influence their valuations, portfolio construction decisions, and transaction underwriting, where relevant.

To inform their assessment framework, teams may utilise ESG research and data as described above as well as support from the dedicated in-house Sustainable Investment team assigned to the investment team. The investment team may also consider the responses of investee company management teams to inquiries focused on their ability and willingness to manage ESG issues. Conclusions about the sustainability risks and factors are documented in investment research. The Sub-Investment Manager may engage with company management to understand their ESG strategy, influence best practices towards disclosure, seek improvement in key sustainability metrics over time, and to address issues pertinent to the specific investment thesis.

Once an investment is made, the investment teams continue to seek to monitor material issues that could impact an asset or company, including sustainability risks, factors and opportunities. Relevant risks or concerns are addressed as part of the investment teams’ ongoing investment process, via ongoing company surveillance and engagement, where relevant, portfolio positioning and risk monitoring.

The Sustainable Investment team may also conduct, on a periodic basis, reviews of individual portfolios, and engage with investment teams about potential sustainability risks as a further support to the investment process. The nature of any material risks identified will inform decisions as to next steps within the context of the investment teams’ overarching investment process, including further company research and company engagement among other considerations.

Responsible stewardship is an integral component of the Sub-Investment Manager’s business and culture.

Engagement with investee companies provides an opportunity to gather further information, which feeds into the Sub-Investment Manager’s due diligence process. The Sub-Investment Manager will also engage to enact positive change in disclosure, management, and performance related to sustainability risks or factors.

The Sub-Fund’s investment team will meet with company management as part of its fundamental research process. These meetings provide analysts and portfolio managers with insights into management quality, business drivers, and the strategies of the companies in which they invest. In addition, these meetings allow the investment team to assess companies’ risk, including exposure to sustainability factors and the companies’ management of that exposure to protect shareholder value. Where appropriate, members of the Sustainable Investment team may also participate in company meetings alongside investment analysts and portfolio managers.

The Sub-Investment Manager also participates in collaborative engagements with other firms in the industry. Engaging collaboratively with other investors amplifies the Sub-Investment Manager’s impact on the companies, industries, and markets in their collective orbit of influence. For the companies the Sub-Investment Manager engages with, collaborative efforts reduce the noise of numerous points of view, helping focus on goal setting and real outcomes. Collaboration is always in alignment with the Sub-Investment Manager’s fiduciary duty to its clients as an asset manager.

If in the Sub-Investment Manager’s opinion issues of concern remain unaddressed by a company’s leadership after a process of engagement conducted over a reasonable period of time, then the Sub-Investment Manager may consider an escalation. Depending on the asset in question, this could include voting their equity proxies in accordance with their views, filing or co-filing a shareholder resolution, or divesting, where applicable.

The Sub-Investment Manager may also occasionally engage with regulators where the Sub-Investment Manager believes it is appropriate and in the best interests of their clients.

For additional detail, please see the Sub-Investment Managers’ ESG Engagement Policy.

1Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector

The Sub-Fund uses the MSCI World NR USD Index as a benchmark for performance comparison purposes only and not as a reference benchmark for SFDR purposes.

Due to the lack of consistent sustainability disclosure requirements and available data in the countries in which the Sub-Fund is invested, the Sub-Investment Manager is not currently able to collect or evaluate complete or reliable data on the environmental objective(s) set out in Article 9 of the Taxonomy Regulation and on how and to what extent the investments underlying the Sub-Fund are in economic activities that qualify as environmentally sustainable under Article 3 of the Taxonomy Regulation (“Taxonomy Aligned Investments”). The Sub-Investment Manager will continue to monitor this position and will seek to improve access to such data where reasonably possible to do so.