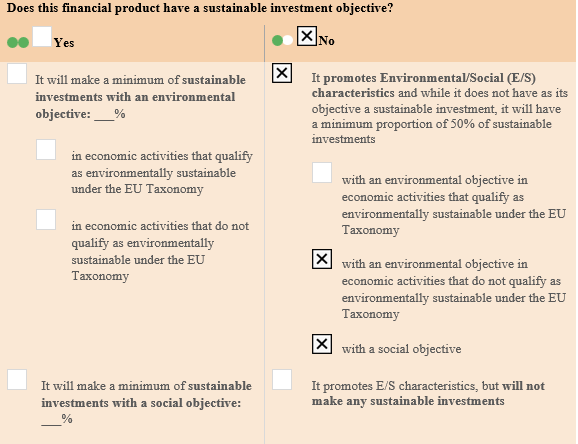

The Sustainable Asia Equity Fund (the Sub-Fund) promotes environmental and/or social characteristics and is therefore considered to be in compliance with Article 8 of the SFDR). It does not have as its objective sustainable investment.

This disclosure is made in compliance with Article 10 of SFDR, and sets out key information with regards to the environmental and/or social characteristics promoted by the Sub-Fund. This information is summarized as follows:

This financial product promotes environmental or social characteristics but does not have as its objective sustainable investment.

However, the Sub-fund does commit to investing a minimum proportion of 50% of its portfolio in sustainable investments. The sustainable investments of the Sub-Fund may contribute to a sustainable objective through their performance in areas such as climate change mitigation, environmental pollution, diversity and inclusion and improved labour standards. The sustainable investments contribute to these objectives through either their products or services (such as revenue contribution from products or services with positive impact), or business practices related (such as adoption of carbon emission reduction targets or product safety management program). In order to be considered a sustainable investment, companies must demonstrate stronger sustainability attributes relative to their peers.

Although the Sub-Fund does not commit to a minimum level of taxonomy alignment, the Investment Manager expects that the Sub-Fund’s sustainable investments may contribute to the environmental objectives of climate change mitigation and natural resource use. The Sub-Fund also has socially focused investments which are not yet designated under the EU Taxonomy.

The Investment Manager has fully integrated ESG considerations into the investment decision making process. As part of this overall approach, the Investment Manager ensures that the sustainable investments made by the Sub-Fund DNSH to sustainable investment objectives by (a) adhering to a detailed exclusion framework, and (b) identifying and considering the PAI on sustainability factors.

Each of these elements is further explained below:

a) Exclusion Framework

The Sub-Fund adheres to an exclusion framework where certain companies are not considered permissible for investment. This includes screening out companies, where possible, which fall within the exclusions criteria of the EU Paris-aligned Benchmarks (“PAB Exclusions”), namely, companies:

a) involved in any activities related to controversial weapons;

b) involved in the cultivation and production of tobacco;

c) that are considered by the third party data provider(s) used by the Investment Manager to be in violation of the United Nations Global Compact (“UNGC”) principles or the Organisation for Economic Cooperation and Development (“OECD”) Guidelines for Multinational Enterprises;

d) that derive 1% or more of their revenues from exploration, mining, extraction, distribution or refining of hard coal and lignite;

e) that derive 10% or more of their revenues from the exploration, extraction, distribution or refining of oil fuels;

f) that derive 50% or more of their revenues from the exploration, extraction, manufacturing or distribution of gaseous fuels; and

g) that derive 50% or more of their revenues from electricity generation with a GHG intensity of more than 100g CO2 e/kWh.

In addition to the PAB Exclusions, the Sub-Fund’s exclusion framework screens out companies with products or within industries that are considered by the Investment Manager to be unsustainable or associated with significant environmental or social risks. Currently, companies deriving more than 5% of revenue from alcohol, tobacco, gambling operations, adult entertainment and conventional weapons are automatically eliminated from investment consideration. The Sub-Fund’s exclusion framework may be updated from time to time. This forms a material part of the Sub-Fund’s DNSH test.

The exclusionary framework explained is aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight fundamental conventions identified in the Declaration of the International Labour Organization on Fundamental Principles and Rights at Work and the International Bill of Human Rights.

b) PAI on sustainability factors

The Investment Manager has assessed the PAI indicators relevant to the Sub-Fund and which the Investment Manager considers should be taken into account for the purposes of assessing whether sustainable investments otherwise cause significant harm.

Based on data availability, the following PAI indicators are taken into consideration for investments in equities and/or fixed income products issued by corporate issuers for the proportion of holdings where data is available:

1. Scope 1 Green House Gas (“GHG”) emissions

2. Scope 2 GHG emissions

3. Scope 3 GHG emissions

4. Total GHG emissions

5. Carbon footprint

6. GHG intensity of investee companies

7. Share of investments in companies active in the fossil fuel sector

8. Share of non-renewable energy consumption and non-renewable energy production of investee companies from non-renewable energy sources

9. Energy consumption in GWh per million EUR of revenue of investee companies, per high impact climate sector

10. Share of investments in investee companies with sites/operations located in or near to biodiversity-sensitive areas

11. Tonnes of emissions to water generated by investee companies per million EUR invested, expressed as a weighted average

12. Tonnes of hazardous waste generated by investee companies per million EUR invested, expressed as a weighted average

13. Share of investments in investee companies that have been involved in violations of the UNGC principles or OECD Guidelines for Multinational Enterprises

14. Share of investments in investee companies without policies to monitor compliance with the UNGC principles or OECD Guidelines for Multinational Enterprises or grievance /complaints handling mechanisms to address violations of the UNGC principles or OECD Guidelines for Multinational Enterprises

15. Average unadjusted gender pay gap of investee companies

16. Average ratio of female to male board members in investee companies

17. Share of investments in investee companies involved in the manufacture or selling of controversial weapons

For investments in sovereign bonds and bonds issued by supranational entities, the following PAI indicators will be considered:

1. GHG intensity of investee countries

2. Absolute number of investee countries subject to social violations

3. Relative number of investee countries subject to social violations

4. Non-cooperative tax jurisdictions

The Investment Manager aims to identify the adverse sustainability impact from the Sub-Fund’s investments in several ways, including via general screening criteria, ongoing review of PAIs and where appropriate supplemented by fundamental research during the Investment Manager’s investment processes. Subject to data availability, the Investment Manager, with subject matter support from the Manulife IM’s Sustainable Investment team, is responsible for assessing and monitoring the above PAI indicators for all in-scope assets on an ongoing basis using an internally developed monitoring system, third-party data, company issued data and public information. This assessment may include both fundamental as well as quantitative analysis. Issuers identified as outliers on specific indicators, or which exhibit high adverse impact across several indicators will be subject to further analysis by the Investment Manager and may be reviewed by the Sustainable Investment team.

All specific PAI indicators that are taken into consideration for the Sub-Fund, both at an overall portfolio level and in relation to the DNSH assessment for sustainable investment, are subject to data availability. The Investment Manager monitors data availability on an ongoing basis with the aim to improve both data quality and availability.

PAI outcomes for the Sub-Fund will be reported on an ongoing basis in the periodic reporting.

The Sub-Fund promotes environmental and social characteristics by investing in issuers who demonstrate sustainability attributes. Whilst the Sub-Fund does not have a sustainable investment objective, it does invest a proportion of its portfolio in sustainable investments.

While the Investment Manager considers a wide variety of sustainability attributes in selecting investments, the particular environmental and social characteristics promoted by the Sub-Fund include:

Provision of products or services to help improve environmental and/or social performance.

The Sub-Fund will seek to invest at least 80% of its net assets in equity and equity-related securities of companies incorporated, located, listed or with significant business interests in Asia, including Australia and New Zealand. Such equity and equity related securities include common stocks, preferred stocks, REITs and depositary receipts. The companies selected for inclusion in the portfolio must meet the Investment Manager’s sustainability criteria, as further described below.

In order to determine the eligible investment universe, the Investment Manager adheres to a positive inclusion screening framework, while also applying exclusionary criteria and a good governance assessment. Environmental, social and governance (ESG) factors, risks and impacts are integrated throughout these processes.

The Sub-Fund’s positive inclusion screen assesses issuers based on either their own sustainability attributes and/or the products or services they offer which enable a more sustainable economy, as measured against comparable companies. The companies eligible for inclusion in the portfolio must exceed a minimum threshold on this positive inclusion screen. Sustainability attributes may include, or be defined or characterised by the Investment Manager as, a company’s performance on and management of environmental factors, such as climate change and natural resource use and/or social factors, such as labour standards and diversity considerations.

As described below, the positive inclusion screen is driven by quantitative element and supplemented by qualitative element (where applicable). Third party data providers’ relevant data at company level is used as primary inputs for the quantitative assessment. Data used can be either products or services related (such as revenue contribution from products or services with positive impact), or business practices related (such as adoption of carbon emission reduction targets or product safety management program). Where such data availability is limited or the Investment Manager considers the quantitative assessment is not a fair or accurate assessment, the analysis may be supplemented with company reported information and/or findings from proprietary analysis, and/or a qualitative assessment and the Investment Manager’s own analysis of available data (such as publicly available ESG reports, assessment reports or case studies).

While all companies must pass the positive inclusion screen, the Investment Manager also seeks to differentiate those companies considered to be “Sustainable Investments”. Sustainable Investments are those companies who demonstrate stronger performance on practices and management of sustainability issues compared to their peers or whose products or services enable sustainable practices. The Sub-Fund will invest at least 50% of its net assets in Sustainable Investments.

In addition to the positive inclusion screening to assess companies which demonstrate sustainability attributes described above, the Sub-Fund also adheres to its exclusion framework (as detailed above).

Where no data is available from the third party data provider(s) regarding compliance with the exclusion framework above, issuers will not be automatically excluded from the Sub-Fund’s investment universe provided that they satisfy other sustainability-related quantitative or qualitative analysis the Investment Manager considers relevant.

Through a combination of the exclusion framework, as well as the limitation of the universe to companies satisfying the Investment Manager’s positive inclusion screen described above, the Investment Manager will remove at least 20% of the investment universe for investment consideration by the Sub-Fund.

Investee companies are screened for good governance principles at the point of investment and on an ongoing basis. This screening process includes sound management structures, employee relations, remuneration of staff and tax compliance, and is based on third party data, and/or a proprietary assessment.

As part of the investment process of the Sub-Fund, the Investment Manager will then apply active stewardship to the selected securities through engagement and proxy voting to encourage improvement of sustainability attributes.

Over time issuers’ eligibility status with respect to the relevant ESG criteria in the Sub-Fund’s stock selection process as described above may change and some issuers who were eligible when purchased by the Sub-Fund may become ineligible. When this occurs, the Investment Manager may engage with issuers to have a constructive dialogue in order to improve factors that lead to ineligibility within the next 90 days. The position in respect of such issuers may be divested at any time or for any reason during this 90-day period.

The following elements of the investment strategy are binding within the selection process:

The Investment Manager is bound to apply this selection process to all potential assets of the Sub-Fund with the exception of cash, cash equivalents and derivatives.

All of the above elements are binding on the Investment Manager on a continuous basis.

Governance safeguards are inherent in the Investment Manager’s level norms-based screening as well as the Investment Manager’s PAI processes for the Sub-Fund.

Furthermore, at the Sub-Fund level, investee companies are screened for good governance principles at the point of investment and on an ongoing basis. This screening process includes sound management structures, employee relations, remuneration of staff and tax compliance, and is based on third-party data, and/or a proprietary assessment.

A proprietary assessment will be used and may take precedence over the third-party data, when the Investment Manager determines to engage with the investee companies or the Investment Manager otherwise evidences the good governance practices of investee companies, or when third-party data is lacking, the Investment Manager applies these principles by assessing issues including, but not limited to: companies’ board composition and oversight, executive compensation, labor management and human capital and tax controversies.

The selection of these specific indicators is subject to change from time to time although the overall principles will remain. Where the Investment Manager identifies any areas for improvement, and subject to an overall assessment of good governance, it may engage with the relevant investee company to seek improvements before choosing to divest, which will typically occur within 90 days. The assessment is not applicable to any cash, cash equivalent or derivatives investment or investments in securities issued by sovereigns or government-related entities.

The Sub-Fund will have a minimum proportion of 80% of its net asset value that is aligned with its environmental and / or social characteristics and a minimum proportion of 50% of its net asset value in sustainable investments.

Derivatives are not used for the purposes of attaining the environmental or social characteristics promoted by the Sub-Fund.

The remaining assets of the Sub-Fund may be invested in equity and equity-related securities of companies outside of Asia that have been identified as meeting sustainability criteria, and/or cash and cash equivalents.

The environmental and/or social characteristics promoted by the Sub-Fund are measured and monitored throughout the lifecycle of an investment using the following sustainability indicators:

The environmental and/or social characteristics and the sustainability indicators of the Sub-fund are monitored during initial security selection and ongoing portfolio management using a combination of internal and external data.

Once an investment is made, and to ensure that investments continue to meet the Sub-Fund’s sustainability criteria, the Investment Manager continues to monitor material factors that could impact an investment, including sustainability risks and factors. Relevant risks or concerns are addressed as part of the Investment Manager’s ongoing investment process which may result in changes in a fund position size or divestment. The Sustainable Investment team may also conduct reviews on a periodic basis, and engage with the investment team about potential sustainability risks. The Investment Manager uses a combination of externally sourced data and proprietary research to ensure that the information used when monitoring of the environmental and/or social characteristics is suitably robust, given the current levels of disclosure by companies, and performs periodic reviews allowing the Sub-Investment Manager to seek to identify gaps and/or data that may require further review. The current level of disclosure of environmental and social characteristics remains comparatively limited in comparison with other financial data, and that which is available is typically subject to more limited review (such as audits).

The Investment Manager’s overall investment process includes both quantitative and qualitative metrics to measure how the social or environmental characteristics promoted by the Sub-Fund are met, including an exclusionary framework, and positive screening.. In addition, the Investment Manager seeks to understand the sustainability risks and opportunities by using a range of external research providers as well as internal research.

Each sustainability indicator for the Sub-Fund is subject to measurement using clearly defined metrics on an ongoing basis, using a combination of internal and external data and research as is appropriate for the particular indicator.

The Investment Manager uses a range of data sources in order to monitor the environmental and/or social characteristics promoted by the Sub-Fund, including both in-house research and third party data provider(s). These are used to systematically screen client portfolios for sustainability risks, identify priority companies for engagement and to inform company analysis as described in the Sub-Fund’s investment policy. The third party data provider(s) are subject to ongoing review and change and may differ between asset classes or sub-funds depending on the nature of the characteristic to be measured.

The main limitation to the methodologies and data sources is the lack of global reporting standards and availability of consistent data. Where data is available, this also has limitations and is subject to estimation and reporting gaps and continues to evolve. The Investment Manager keeps under review the sources of data it uses for the implementation of its sustainability policy and will make changes where it considers this is necessary.

In case data gaps pose challenges to making an informed decision on an aspect of the investment process the Investment Manager’s sustainable investment specialists, together with the investment analysts and fund managers may seek further information. Such options may include a direct dialogue with the company, a dedicated engagement plan or a decision against holding the company.

Due diligence is a key element of the methodology for integrating sustainability factors into the investment decision making process, on both a pre-investment and ongoing basis. As part of the due diligence process, the investment team seeks to assess sustainability risks and factors material to an investment, and incorporate these issues into fundamental analysis, which then may influence their valuations, portfolio construction decisions, and transaction underwriting, where relevant.

To inform their assessment framework, teams may utilise ESG research and data as described above as well as support from the dedicated in-house Sustainable Investment team assigned to the investment team. The investment team may also consider the responses of investee company management teams to inquiries focused on their ability and willingness to manage ESG issues. Conclusions about the sustainability risks and factors are documented in investment research. The Investment Manager may engage with company management to understand their ESG strategy, influence best practices towards disclosure, seek improvement in key sustainability metrics over time, and to address issues pertinent to the specific investment thesis.

Once an investment is made, the investment teams continue to seek to monitor material issues that could impact an asset or company, including sustainability risks, factors and opportunities. Relevant risks or concerns are addressed as part of the investment teams’ ongoing investment process, via ongoing company surveillance and engagement, where relevant, portfolio positioning and risk monitoring.

The Sustainable Investment team may also conduct, on a periodic basis, reviews of individual portfolios, and engage with investment teams about potential sustainability risks as a further support to the investment process. The nature of any material risks identified will inform decisions as to next steps within the context of the investment teams’ overarching investment process, including further company research and company engagement among other considerations.

Responsible stewardship is an integral component of the Investment Manager’s business and culture.

Engagement with investee companies provides an opportunity to gather further information, which feeds into the Investment Manager’s due diligence process. The Investment Manager will also engage to enact positive change in disclosure, management, and performance related to sustainability risks or factors.

The Sub-Fund’s investment team will meet with company management as part of their fundamental research process. These meetings provide analysts and portfolio managers with insights into management quality, business drivers, and the strategies of the companies in which they invest. In addition, these meetings allow the investment team to assess companies’ risk, including exposure to sustainability factors and the companies’ management of that exposure to protect shareholder value. Where appropriate, members of the Sustainable Investment team may also participate in company meetings alongside investment analysts and portfolio managers.

The Investment Manager also participates in collaborative engagements with other firms in the industry. Engaging collaboratively with other investors amplifies the Investment Manager’s impact on the companies, industries, and markets in their collective orbit of influence. For the companies the Investment Manager engages with, collaborative efforts reduce the noise of numerous points of view, helping focus on goal setting and real outcomes. Collaboration is always in alignment with the Investment Manager’s fiduciary duty to its clients as an asset manager.

If in the Investment Manager’s opinion issues of concern remain unaddressed by a company’s leadership after a process of engagement conducted over a reasonable period of time, then the Investment Manager may consider an escalation. Depending on the asset in question, this could include voting their equity proxies in accordance with their views, filing or co-filing a shareholder resolution, or divesting, where applicable.

The Investment Manager may also occasionally engage with regulators where the Investment Manager believes it is appropriate and in the best interests of its clients.

For additional detail, please see the Investment Manager’s ESG Engagement Policy.

1 Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector

The Sub-Fund uses the MSCI AC Asia ex Japan NR USD Index as a benchmark for performance comparison purposes only and not as a reference benchmark for SFDR purposes.

As a result of the nature of the assets in which the Sub-Fund is invested, and particularly the geographical focus of the Sub-Fund, the Investment Manager is not currently able to collect or evaluate complete or reliable data on the environmental objective(s) set out in Article 9 of the Taxonomy Regulation and on how and to what extent the investments underlying the Fund are in economic activities that qualify as environmentally sustainable under Article 3 of the Taxonomy Regulation (“Taxonomy Aligned Investments”). The Investment Manager will continue to monitor this position and will seek to improve access to such data where reasonably possible to do so.